Packaging World: The largest recycler in North America, WM, is making critical investments in AI, automation, and innovative technology to modernize its recycling facilities and expand recycling access to communities in a more than $1 billion planned investment through 2026. How is that money being distributed?

Brent Bell, VP of recycling at WM (formerly Waste Management)

Brent Bell, VP of recycling at WM (formerly Waste Management)

Brent Bell: First, we’re going into new markets where there's not really a lot of recycling processors today. We know that there's a demand for more consumers to get access to recycling, so we want to give them the processing infrastructure to do that. One great example is Fort Walton Beach in the Florida panhandle. During COVID, there were a lot of folks that relocated to that part of the country because they could work remotely. They came from areas that had strong recycling programs and arrived to find there was little recycling infrastructure there. So WM is there and in other new markets to unlock supply material that is currently going to the landfill.

Then in our existing facilities and markets, we're automating with the latest technology, including AI. What that new automation does for existing facilities is make a much higher quality bale of material. A lot of the brands want to use recycled plastic in a bottle-to-bottle fashion, or they want to get their own recycled materials back into their packaging. Whether that's because of minimum [recycled] content laws or because of their own sustainability goals, they want it. We're able to make a higher quality material because we're able to sort this optically and with AI technology. A side effect is we’re able to reduce labor, which a nice tradeoff because labor in those [material recover] facilities is often hard to get. We’re also upgrading our labor staff with more modern technology. The folks at these recycling facilities are now using tablets, and they're programming the optical sorters with computers these days. And the biggest benefit is that it increases our capacity. In the same footprint where we may have processed 20 to 25 tons per hour, we're now able to process 40, 45 tons per hour with the latest optical tech.

Where in your facilities is AI making this difference?

It's predominantly being applied to the optical systems, on the near infrared (NIR). Those opticals are sorting at a thousand picks per minute. The quicker they can identify material and those objects, the better.

There also have been some great cases where we we're using it to identify different compositions on certain lines. Or from a safety perspective, we’re looking to use AI to identify propane tanks, batteries, or other items that could be dangerous at a facility. We could use AI in the future to look at the material streams and learn what kinds of products are we seeing. We could go back to certain brands and let them know if we’re seeing one of their products or classes of products, or if we’re not seeing it in our recycling streams.

And if you think about extended producer responsibility (EPR) and some of those programs in the future, think that data's going to be more relevant. It will help us learn how much of [a given brand’s] material actually gets recycled. That’s why WM is working with brands to make sure the products they're putting on the shelves is recycling friendly, and designed in such a way that this AI can account for it, so that the optical scanners can recognize these materials and properly put them in the right buckets.

How do these collaborations between WM and brand owners take shape, and what do they entail?

Just yesterday I was with a major brand, and we had this exact discussion. Because we're designing this equipment that hopefully lasts in these communities for five or 10 years to come, we need their input up front. The beauty of some of the new technology is we can adapt it to changing packaging, but it's only helpful if we're working with the brand from day-one. When they invent that product and to start designing their packages, we need to make sure that we can accommodate those; that they will be recycling friendly at the end of their life. We’ve always had this open door if you will. We’re happy to either test or otherwise help identify whether your new product or package is going to be recovered. We'd love to be involved on day-one to determine if our new automation sites handle that package, to recognize and properly sort it.

But WM’s high-efficiency facilities with high-tech AI optical sorters aren’t the only ones out there. You have to account for older recycling infrastructure, too, right?

Right. If we can handle it, then that's great. But we are also pragmatic, knowing that there's a lot of recycling facilities that we don't process material for. We have to consider the average MRF or recycling facility in the U.S. Would they be able to process it as well? Because, for a brand, they're not just going to go forward if WM can process a package at their new facilities, but all the other older facilities can’t. So we want to make sure we approach that as, ‘Hey, listen, while we may be able to process this, others may have a challenge. So why don't you just try to make that bottle out of clear plastic instead.’

How do you talk to brands about colored vs. clear bottles?

Bottles are the classic example. Every bottler wants clear back, they don't want the greens and they don't want the blues. Colored PET typically ends up the textile industry. And that's fine, and that’s a great market for. But if a brand truly wants to be bottle-to-bottle, you can't be packaging your product in green or blue bottles, expecting to get back clear. That's just not a realistic tradeoff. At some point, a brand has to get marketing and sustainability teams to work together to balance between a bottle that’s still attractive on a store shelf, but also recycling friendly. We're here to help to make sure that it's designed properly from the get-go.

What other sorts of advice do you find yourself giving brands to make their package designs both more recoverable and valuable to end markets?

Some of the new PET bottles you've seen on the shelves have a full shrink wrap on top of them. If that shrink wrap is polypropylene, but the bottle is HDPE or PET, the first optical or AI is going to recognize that as being polypropylene. So we advise brands try to make the grade of resin consistent throughout that bottle. And from a flexible packaging perspective, the multilayers and the different layers of commodities, that doesn't make it recycling friendly because it's impossible to separate all the different layers in there. The big question is, how can we still give your consumers what they want, the, and the brand and the marketing team what they want, but also make it recycling friendly at the end of the lifecycle? We want to see what those packs are up front, maybe before going to market, so we can offer some suggestions that might have a negligible impact cosmetically, but a major impact on the backend, on the recyclability.

What about small format packaging recovery?

What we call small is less than three by three inches. The small stuff, quite frankly, is always going to be somewhat of an issue with curbside recycling. We're looking at other solutions, like home channels where consumers can put all their plastics in a bag that then goes into the bin. But those aren't ideal for automated facilities because the scanner is going scan on the outside of the bag, and we don't have enough employees to spend on handpicking these bags.

So we don't have a perfect answer for the small, three- by three-inch or less packaging, and it’s not accepted in our programs today. But as we're looking at EPR, and everyone wants to get materials back, maybe a non-curbside solution that can address the small format.

When making this investment, what kind of brand or CPG input did you receive?

The one thing we heard loud and clear when we were making these investments was that there was going to be demand for recycled material. That could be the result of internal sustainability goals, or of legislated minimum content requirements, or both. If you go down the list of every major brand, see what they're doing today, and then see what they want to do tomorrow, it's a massive, massive ramp up on reusing recycled materials in packaging. Let's take plastics as an example. It has a relatively low recycling rate today, so we're going to need five to 10 times as much plastic to get recycled to even become close to meeting these brands' goals. We asked ourselves, ‘how do we unlock more supply, and not just take market share away, but how do we go and get markets, and capture and supply material that's going to the landfill today?’

Our portfolio of new capacity, plus new markets, is about 2.8 million, almost 3 million tons of new capacity that we're going to open that will unlock supply that's going to the landfill today, and put that back into the recycling facilities that we're investing in. That said, plastics is about 5% of what we deal with. That 3 million tons, it's all grades. It's just a blended, single-stream pile. But we are doing education campaigns specifically around plastics because it's one of the highest value materials we collect. And because of the way we share our commodity values with the inbound customer—typically a municipality—then if they can increase the amount of plastics in their bin, that helps out their economics as well. We’re trying to promote good recycling practices to make these curbside programs successful, and increasing the recycling of plastics is a key to doing that. Inevitably that will create more material that we can get in the curbside programs, which will make more material available for these brands to hit their sustainability goals and minimum content requirements that are coming in a few years as well.

Polypropylene is emerging as a more valuable, desirable recycled material in the U.S. Where is WM on that stream?

Ten years ago, polypropylene was just hidden in the [plastic recycling symbol] three through seven bales. For the most part, people that were buying three through seven bales were buying them to try to get the remaining ones and twos out, since some would sneak through. The irony to it all was that anybody that was making a three through seven bale, the real value was just what got left over. We started working with KW Plastics nearly 15 years ago, that was their first polypropylene order from us. That's obviously a business that's grown. It's been a great story for them because we're collecting polypropylene, and KW turns it into paint cans that are now on the shelves of Home Depot, Lowe's, and all the retailers.

We've increased our polypropylene over the last few years by 40%. Most or all recycling facilities now sort polypropylene. The economics are just too good to pass up. We see that as growing for more and more recyclers to actually process it separately. But also more importantly, we're seeing that being a go-to grade to use for brands who had been using a generic number seven grade. We've seen a lot of them switch over to polypropylene to use their materials because they see it's recycling friendly. It's a good packaging grade to use, and now if you go down the store shelves, there's way more polypropylene—yogurt, butter dishes, etc.—a lot more than in year's past. As long as the size is greater than three by three, it’s a valuable material.

| Read more about curbside film recovery and recycling projects, such as WM's in Hickory Hills, Illinois, from a panel of experts including Brent Bell of WM. |

I’ve heard you say that plastics is only about 5% of the material you collect, but it creates something like 90% of the conversations. Will that always be the case?

It shocks people is when we say that, but it’s true. In the average stream today, if you look at anybody's average bin, it's got cardboard, mixed paper, aluminum, steel, and plastics, but plastics are only 5%. And that's a pretty small piece for us to deal with, but it's a big part of the conversation because that's what's in the newspapers. Whether it's ocean plastics or plastic pollution or single-use plastics, people want to know what else we can do with it. We're trying to do our share to make sure that there's an infrastructure in place to increase the recycling rate of all commodities. But specifically, if you can increase it on plastics, then it helps out the economics with everyone in that recycling value chain.

Consumer recycling remains voluntary. Does that need to change to get to the volumes of PCR that brands say they’ll need?

That's the most amazing thing that I think people overlook. They don't realize that, for the most part, curbside recycling is completely a volunteer program. There’s nothing to force someone to recycle at a curbside program. I get that in California, there's some laws with commercial, but for residential, no one's forcing you to recycle. It's the right thing to do, but it's a volunteer effort. That’s where we’re really trying to share that message, ‘Hey, the economics work if you don't put this stuff in a landfill. It's way too valuable. Let's, let's make sure that it gets recycled.’

But even more surprising, this voluntary program is one that big chunks of the supply chain rely on. During COVID, we had a lot of communities that were short on drivers, so they had to stop their recycling routes. We got notifications from our plastics vendors, from our cardboard folks, because there are certain parts of the value chain that can't use virgin material anymore. They have committed their whole process to using recycled content. We sent these communities letters back saying that we knew there's a shortage of toilet paper and tissue supplies for hospitals. Those all get delivered in boxes, and those boxes are made from paper mills that can only use recycled material. That means we can't have a disruption in the recycled material supply chain, or else it's going to really impact your grocery store shelves and your hospitals. I don't think that the average community is aware that recycling is a necessity in the supply chain now.

What’s on the horizon in terms of recycling films? Are we going to evolve beyond store drop-off and get to curbside film recycling?

There's a place just outside of Chicago called Hickory Hills where we’re doing a curbside film recycling pilot. We started another one in the Salt Lake City area as well to unlock that stream. Meanwhile, we’re automating our MRFs to be ready for films. In some cases, we're initially putting in the whole film system. And in other cases, we're just making sure that it's engineered so that we can put a film system in place in the future. Once we get done with these pilots—at some point, and we're not there yet—the goal is that we can tell consumers to put all their plastics in the bin. Because people get confused with recycling, and when you ask them what they’re confused about, they generally say plastics. So we hope to eventually tell them to always recycle plastic. They can put it all in there and then we can sort it, whether it's film or rigids, at these automated recycling facilities. We didn't know initially, until we did the pilots, if we were even capable of doing this. And interesting enough, even without accepting it, film represents about one to 2% of our materials in the bin to begin with. It's a pretty high percentage to begin with, even though it's not accepted in any of these programs. That's where these pilots’ results will be fascinating, in part to see how much more material we can actually collect. But we're starting with film pilots now, uh, and then if those go well, we’ll scale them.

How are these pilots in Hickory Hills, Ill. and Salt Lake City performing so far?

In a way, we're kind of forcing it to work because we're pretty committed to it. Even if we don't officially accept film in our curbside programs, we can still take the 2% out that we're getting today, and make sure that we have good end markets for this material. That’s going to be the next big step in film recycling—making sure that we've got good, secure end markets that are sustainable. Then, we can start going into communities and putting films on their acceptable items list. Not all communities at once, we’ll phase it in. That'll be the next step of that process.

From a mechanical recycling perspective, how do you view the advent of chemical or advanced recycling?

There are like $8 billion in projects related to chemical recycling going on today. I don't know how many will get finished. We’ve already talked about brands’ demand for PCR materials to go back into their products. The demand for material for chemical recycling in a few years, with all these new plants, is going to be huge. So we're trying to unlock more supply. Our view is that mechanical recycling will always take a precedent over chemical, but chemical is going to be absolutely needed for what I'll call the non-mechanical recycling-friendly plastic grades. It definitely has a home in the recycling infrastructure. We’re excited for those folks to come online and start taking some material that isn't really all that easy to mechanically recycle today.

Are you keeping an eye on HolyGrail 2.0, digital watermarking tech, and digital passports as pilots begin to scale in Europe?

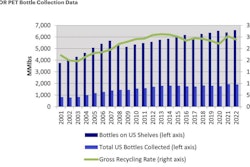

It’s really interesting, but the viewpoint I have on that is kind of simplistic. They can put all these digital codes on the packaging if they want, but if people are still putting in it the trash bin and not recycling it, it doesn't matter because none of my machines are ever going to read it. I have to get the material out of the trash bin and into the recycling bin. My view is that we're a long way away from [digital watermarks and passports] being a benefit. I need just people to recycle. Everybody knows that a plastic bottle is recyclable, but we're only getting three out of every 10 of these in the right bin. We just need to get folks to put the right materials in the right bin first. If machines can read that material at some point, and that adds to better sortation, that'll be great. But if it goes in the trash bin, it's not going to do anybody any good.

Packaging World readers are brand owners, CPGs, FMCGs, and food, beverage, and pharma companies who rely on packaging to deliver their products to consumers. Do you have any parting thoughts for them?

I would say that we hear their message loud and clear. Whether it's through your own sustainability goals or through regulation, there’s a big and growing demand for recycled material and a need for companies like WM to unlock more material. We're making investments in infrastructure to do just that. Any help we can provide on education or help on making sure your packaging designs and materials are recycling friendly, our doors are open for that. Because we want this to be successful for everybody, and to increase the recycling rate. The overall goal is to get more material in this circular economy backing the right hands. We're excited to be a part of that. PW